In the ever-evolving business hub of Dubai, managing finances properly is crucial for success. Whether you run a small startup or a large multinational corporation, bookkeeping services in Dubai play a vital role in maintaining financial health, ensuring compliance, and fostering business growth.

We will cover everything you need to know about bookkeeping services in Dubai , including why they're important, how to choose the right provider, and tips to make the most out of your financial management strategy. Let’s dive deep into this essential aspect of running a business!

What is Bookkeeping?

At its core, bookkeeping is the organized recording, storing, and retrieval of a company's financial transactions. It involves tracking sales, purchases, receipts, and payments. Proper bookkeeping ensures that businesses maintain accurate financial records, making it easier to manage finances, prepare for audits, and meet tax obligations.

In Dubai, where financial regulations are stringent and business operations are dynamic, having a robust bookkeeping system is non-negotiable.

Why Bookkeeping Services are Essential in Dubai

Dubai’s business environment is sophisticated, with strict compliance requirements such as VAT (Value Added Tax) reporting, corporate tax filings, and financial audits. Without accurate bookkeeping, businesses risk penalties, financial losses, and reputational damage.

Benefits of professional bookkeeping services in Dubai include:

Ensuring tax compliance

Enhancing financial transparency

Improving cash flow management

Supporting better business decisions

Facilitating easier audits and investor relations

In short, professional bookkeeping is not just about record-keeping—it's about empowering your business to thrive.

Types of Bookkeeping Services Offered in Dubai

There are several types of bookkeeping services in Dubai available to businesses in Dubai, including:

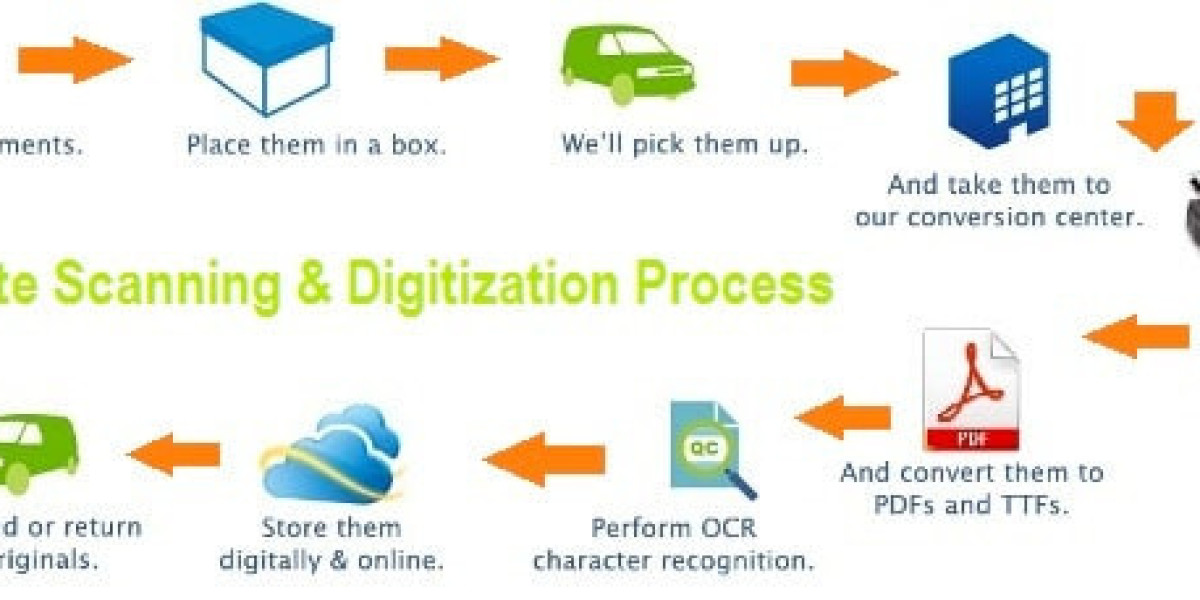

On-site bookkeeping: A bookkeeper works from your office.

Remote bookkeeping: Services are offered virtually using cloud accounting software.

Full-charge bookkeeping: Includes managing accounting, financial statements, and sometimes payroll.

Specialized bookkeeping: Focused on niche industries like real estate, retail, or tech startups.

Choosing the right type depends on your business size, budget, and specific needs.

How Bookkeeping Differs from Accounting

Many people confuse bookkeeping with accounting, but they serve different purposes.

Bookkeeping is the daily recording of financial transactions.

Accounting involves interpreting, analyzing, and summarizing financial data for decision-making.

While bookkeeping lays the foundation, accounting builds upon it to offer strategic financial advice. In Dubai, most businesses rely on both services to remain competitive and compliant.

Key Features to Look for in Bookkeeping Services

When selecting a bookkeeping service provider in Dubai, consider these crucial features:

Expertise in UAE tax laws and regulations

Proficiency in top accounting software (e.g., QuickBooks, Xero, Zoho Books)

Transparent pricing with no hidden fees

Regular financial reporting and analysis

Secure data handling and confidentiality

Ability to customize services according to your business model

Choosing the right bookkeeping partner can make a significant difference in your financial management.

How VAT Affects Bookkeeping in Dubai

Since the introduction of VAT in the UAE, businesses must carefully manage VAT collections, payments, and returns. Bookkeeping services in Dubai ensure that VAT transactions are properly recorded and that VAT returns are submitted accurately and on time.

Key VAT-related tasks handled by bookkeeping services in Dubai include:

Issuing VAT-compliant invoices

Maintaining VAT transaction records

Filing VAT returns to the Federal Tax Authority (FTA)

Advising on VAT refunds and penalties

Proper VAT bookkeeping helps avoid hefty fines and ensures your business remains compliant with local regulations.

Popular Accounting Software Used in Dubai

Modern bookkeeping services in Dubai often rely on advanced accounting software to streamline operations. Some of the most popular options in Dubai include:

QuickBooks Online: Ideal for small to medium businesses.

Xero: Great for businesses that need scalable cloud-based solutions.

Zoho Books: A favorite among startups and SMEs for its affordability.

Sage Accounting: Preferred by larger businesses for its comprehensive features.

A good bookkeeping service will help you select and implement the best software for your needs, offering training and ongoing support.

Costs Involved in Hiring Bookkeeping Services

The cost of hiring bookkeeping services in Dubai varies depending on several factors:

Size and complexity of your business

Frequency of service (weekly, monthly, quarterly)

On-site vs remote services

Additional services like payroll, tax filing, or financial consulting

On average, outsourced bookkeeping is far more cost-effective than hiring a full-time, in-house bookkeeper. Moreover, you get access to a team of experts instead of relying on a single individual.

Outsourcing vs In-House Bookkeeping: Which is Better?

Both options have their pros and cons, but in Dubai’s competitive market, outsourcing bookkeeping services in Dubai has clear advantages:

Cost savings: No need for employee benefits, office space, or training costs.

Expertise: Access to specialists in UAE tax laws and accounting standards.

Scalability: Easily scale up or down as your business grows.

Focus: Free up internal resources to concentrate on core business activities.

Unless your business has extremely complex needs that require a full-time presence, outsourcing is generally the smarter choice.

Common Mistakes to Avoid in Bookkeeping

Even with professional services, it's important to avoid common bookkeeping mistakes, such as:

Mixing personal and business finances

Delaying data entry

Not backing up financial data

Ignoring petty cash transactions

Failing to reconcile bank statements regularly

A trusted bookkeeping service will help you set up systems to prevent these issues and maintain accurate records year-round.

How to Get Started with Bookkeeping Services in Dubai

Ready to professionalize your finances? Here's a step-by-step approach to getting started:

Assess your needs: Understand the level of service you require.

Research providers: Compare based on expertise, services offered, and reviews.

Request consultations: Speak with a few firms to understand their approach.

Choose the right partner: Select a service provider that aligns with your business goals.

Set clear expectations: Define reporting schedules, deliverables, and communication protocols.

Remember, good bookkeeping is a partnership, not just a transaction.

The Future of Bookkeeping in Dubai

As technology evolves, automation and AI are beginning to transform bookkeeping practices in Dubai. Many firms are embracing:

AI-driven data entry

Predictive financial analytics

Blockchain-based record keeping

Real-time dashboards and reporting

Businesses that adapt early to these innovations will enjoy better financial insights and greater operational efficiency.

Final Words : Bookkeeping is the Backbone of Business Success in Dubai

In the dynamic and highly regulated environment of Dubai, solid bookkeeping practices are crucial for any business that aims to succeed and grow. Whether you’re a budding entrepreneur or a seasoned business owner, investing in professional bookkeeping services in Dubai is a smart move.

With the right provider, you can ensure compliance, improve financial transparency, optimize cash flow, and plan strategically for the future. Stay proactive, embrace technology, and partner with experts to secure your business’s financial well-being.

Remember, a strong financial foundation today is the key to greater opportunities tomorrow!